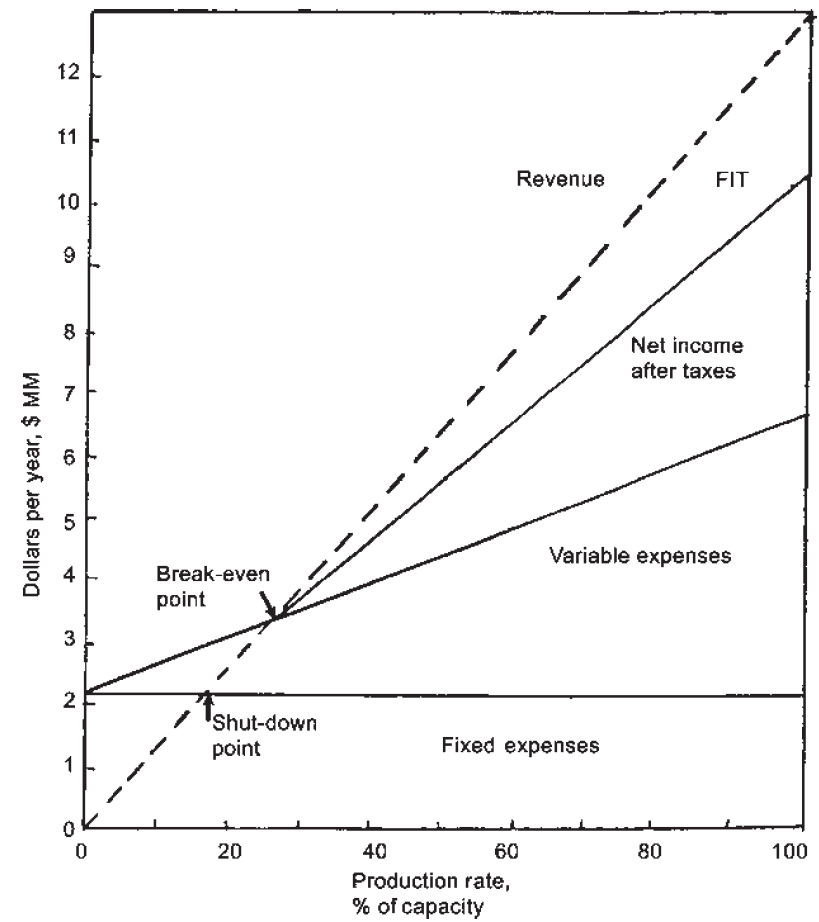

Profit is net income after taxes.

(FIT is corporate federal income tax.) [1]

Profits… resulting from the relationships of costs to prices, not only tell us which goods it is most economical to make, but which are the most economical ways to make them.

…profits… put constant and unremitting pressure on the head of every competitive business to introduce further economies and efficiencies…

…the prospect of profits decides what articles will be made, and in what quantities—and what articles will not be made at all. If there is no profit in making an article, it is a sign that the labor and capital devoted to its production are misdirected: the value of the resources that must be used up in making the article is greater than the value of the article itself.

…profits… guide and channel the factors of production so as to apportion the relative output of thousands of different commodities in accordance with demand.

The total profits of General Motors… are taken as if they were typical rather than exceptional.

Profits actually do not bulk large in our total economy. The net income of incorporated business in the fifteen years from 1929 to 1943, to take an illustrative figure, averaged less than 5 per cent of the total national income.

…what government officials would undoubtedly regard as “excessive” or “unreasonable” profits… would not only cause every firm in that line to expand its production to the utmost, and to reinvest its profits in more machinery and more employment; it would also attract new investors and producers from everywhere, until production in that line was great enough to meet demand, and the profits in it again fell to the general average level.

Few people are acquainted with the mortality rates for business concerns. They do not know… that “should conditions of business averaging the experience of the last fifty years prevail, about seven of each ten grocery stores opening today will survive into their second year; only four of the ten may expect to celebrate their fourth birthday.”

…any individual placing venture capital runs a risk not only of earning no return but of losing his whole principal.

…over a long period of years, after allowance is made for all losses, for a minimum “riskless” interest on invested capital, and for an imputed “reasonable” wage value of the services of people who run their own business, no net profit at all may be left over, and that there may even be a net loss. …optimism and self-confidence too often lead… into ventures that do not or cannot succeed.[2]

- Couper, James Riley. Process engineering economics. Marcel Dekker, 2003. p. 256.

- Hazlitt, Henry. Economics in one lesson. Harper & Brothers, 1946. pp. 168-172.