[1]

The proper function of government is to protect life, liberty, property and contract rights… …the real reason why totally free and unrestricted trade is good is because it is the only trade policy that does not violate individual rights. …a proper position to take is that a trade policy should be implemented or adopted if it does not violate anyone’s rights.

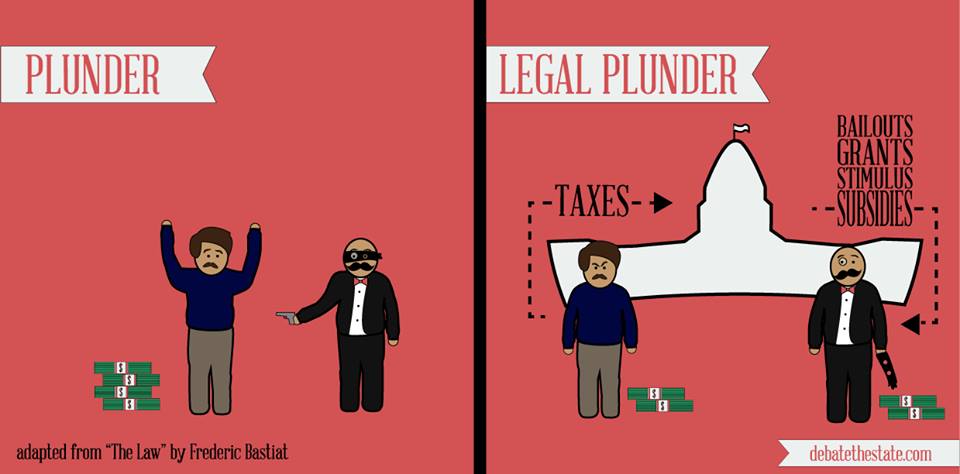

When government goes beyond… basic functions of protecting life, liberty and property, it becomes a redistributive state. In order to give something to some individuals or groups, it must first take something from others because governments have no resources of their own. Frederic Bastiat… had the following view of what determines whether a law is good or bad:

“See if the law takes from some persons what belongs to them, and gives it to other persons to whom it does not belong. See if the law benefits one citizen at the expense of another by doing what the citizen himself cannot do without committing a crime. Then abolish this law without delay, for it is not only an evil itself, but also it is a fertile source for further evils because it invites reprisals. If such a law – which may be an isolated case – is not abolished immediately, it will spread, multiply, and develop into a system.”

Such laws constitute legal plunder for Bastiat because they allow some individuals to use the force of government to rob others.

Trade laws like NAFTA, GATT and the others do the same. NAFTA, GATT and the other trade agreements that are hundreds or even thousands of pages long are not really about free trade. They are about how the plunder gained from protectionism is to be divvied up. They go into great detail describing which special interest is protected for how long. Farmers, the steel industry, the auto industry, the textile industry and countless other special interest groups all receive special deals in many of these so-called “free” trade agreements. These free trade laws have developed into the systems that Bastiat warned us about.

NAFTA, GATT and all other trade agreements are fatally flawed…

If NAFTA were a true free trade agreement, it would only require one sentence… something like this: “As of January 1, 1994, all trade exclusively involving Mexico, the United States and/or Canada will be treated the same as trade involving New Jersey and Kansas.” But NAFTA (and the numerous other trade agreements that could be named) do not have such language.

If a trade agreement would violate anyone’s contract or property rights, the policy should not be adopted.

…if an existing trade policy violates anyone’s contract or property rights, it should be abolished immediately. [2]

- Hughey, Jason. “When Government Steals From Us.” DebatetheState, 14 Oct. 2013, www.debatethestate.com/tag/plunder/. Accessed 30 Nov. 2014.

- McGee, Robert W. “The Fatal Flaw in NAFTA, GATT and All Other Trade Agreements.” Northwestern Journal of International Law & Business 14.3 (1994): 549-565.