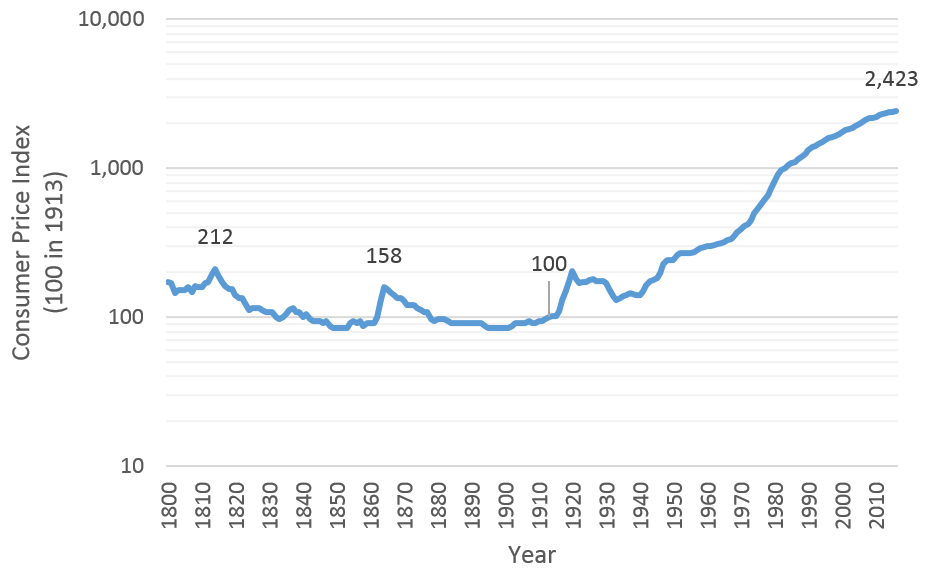

US Consumer Price Index for 1800-2016,[1]

scaled so 1913 CPI = 100

Under private control between wars before 1913, prices fell; a dollar bought more. Under government control since 1913, prices shot upward; a dollar buys less.

Money control by government people is not natural

Money is a government monopoly.

If there is no incentive to please consumers, the products or services monopolies sell tend to be more expensive and of lower quality than would be the case under competition, where a number of firms are free to compete for the consumer’s business.

Natural rights theorists argue that individual rights are being violated if government, which is supposed to protect property and political rights, prevents individuals from entering a line of business.

Money is not a natural government monopoly. It came into existence spontaneously out of the market process. Gold and silver coins, and promises to pay in gold and silver, have served consumers well for hundreds of years. From 1839 until the advent of the Federal Reserve Bank in the United States in 1913, most money in circulation consisted of privately issued bank notes…

Money control by government people is unstable and does us outsized harm

“The economy has been much less stable since the establishment of the Fed restored a government monopoly in currency issuance. The wholesale price index in 1913 [the year the Federal Reserve Board came into existence] was 87 percent of what it had been 73 years earlier… By contrast, in the 73 years since the founding of the Fed, the wholesale price index has risen to 825 percent of its 1913 level.”

“What we should have learned is that monetary policy is much more likely to be a cause than a cure of depressions, because it is much easier, by giving in to the clamour for cheap money, to cause those misdirections of production that make a later reaction inevitable, than to assist the economy in extricating itself from the consequences of overdeveloping in particular directions. The past instability of the market economy is the consequence of the exclusion of the most important regulator of the market mechanism, money, from itself being regulated by the market process.”

“Just as the absence of competition has prevented the monopolist supplier of money from being subject to a salutary discipline, the power over money has also relieved governments of the necessity to keep their expenditure within their revenue…There can be little doubt that the spectacular increase in government expenditure over the last 30 years, with governments in some Western countries claiming up to half or more of the national income for collective purposes, was made possible by government control of the issue of money.”

Government control over the money supply increases centralization, which tends to reduce individual freedom. Asserting economic control over the individual also runs the risk of political control, since economic and political freedom are intertwined.

Money control won’t be given up easily by Progressive government people

One way to minimize this excessive control over the individual is to prohibit government from controlling the money supply. “One of the most effective measures for protecting the freedom of the individual might indeed be to have constitutions prohibiting all peacetime restrictions on transactions in any kind of money or the precious metals.”

Unfortunately, constitutions have a tendency to get twisted beyond recognition by the courts, at least that has been the American experience, so having a constitutional provision is not a perfect solution either. But it is better than nothing.

The long-run solution seems to be to phase-out government money as private money takes its place. Once government money is abolished there will be less pressure to restore the government’s monopoly position.

Money control by business people would be self-regulated by producers and consumers

Initially, the introduction of private money would be slow. However, over time, the money that holds its value best would be preferred over money that depreciates in value — the exact reverse of Gresham’s Law, which holds that bad money drives good money out of circulation. Gresham’s Law only holds true when government sets fixed exchange rates between or among competing currencies.

Thus, money would act just like other goods and services. Consumers would shop for the brand that best serves their needs. They would prefer stable currencies to unstable ones, and the market would weed out the bad from the good.[2]

- “Consumer Price Index (Estimate) 1800-.” org, www.minneapolisfed.org/community/teaching-aids/cpi-calculator-information/consumer-price-index-1800. Accessed 25 Mar. 2017.

- McGee, Robert W. “The Case for Privatizing Money.” The Asian Economic Review 30.2 (Aug. 1988): 258-273.