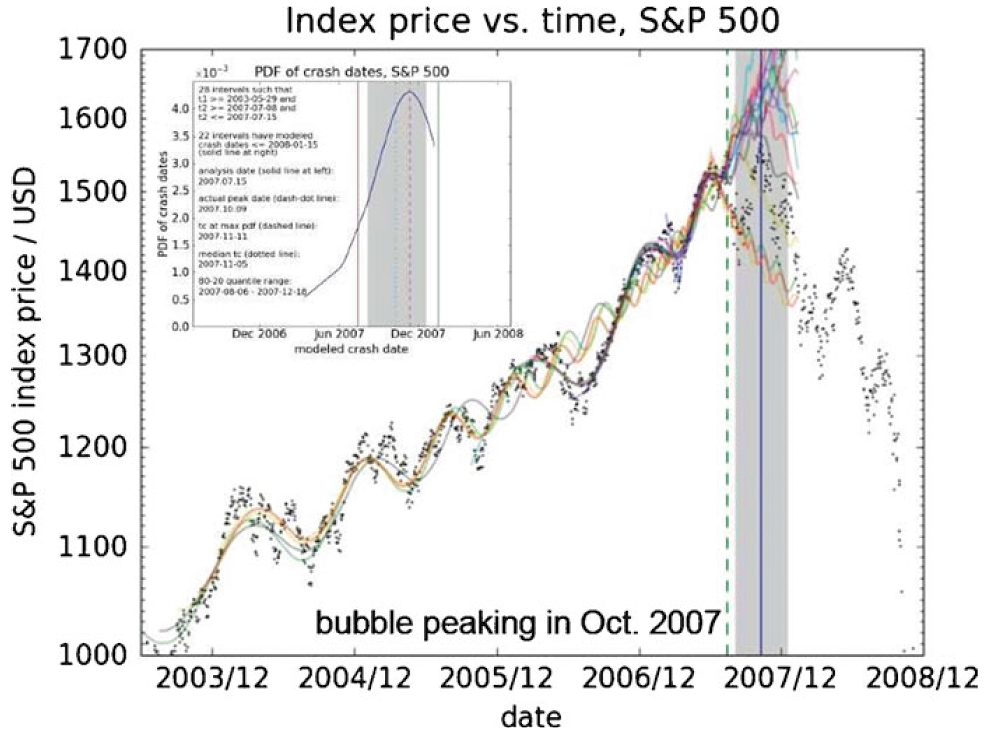

Financial crisis data and model estimations

dots – S&P 500 index data

dashed vertical line – last time in calibration data

smooth curves – estimations using various time windows

grey zone – 80% confidence interval

inset – probability density function [1]

The financial crisis was a panic and a run on demand deposits

…the basic economic structure of our financial crisis was the same as that of the panics and runs on demand deposits that we have seen many times before.

The run defines the event as a crisis. People lost a lot of money in the 2000 tech stock bust. But there was no run, there was no crisis, and only a mild recession. Our financial system and economy could easily have handled the decline in home values and mortgage-backed security (MBS) values—which might also have been a lot smaller—had there not been a run.

The central task for a regulatory response, then, should be to eliminate runs.

Runs come from contracts with promises that people can’t keep

Runs are a pathology of specific contracts, such as deposits and overnight debt, issued by specific kinds of intermediaries. Among other features, run-prone contracts promise fixed values and first-come first-served payment. There was no run in the tech stock bust because tech companies were funded by stock, and stock does not have these run-prone features.

The central regulatory response to our crisis should therefore be to repair, where possible, run-prone contracts and to curtail severely those contracts that cannot be repaired.

When they failed, Bear Stearns and Lehman Brothers were financing portfolios of mortgage-backed securities with overnight debt at 30:1 leverage. For every thirty dollars of investment, every single day, they had to borrow a new twenty-nine dollars to pay back yesterday’s lenders. It is not a surprise that this scheme fell apart.

Instead of micromanaging the people, just eliminate the run-prone contracts

It is a surprise that our policy response consists of enhanced risk supervision, timid increases in bank capital ratios, fancier risk weighting, macroprudential risk regulation, security-price manipulation, a new resolution process in place of bankruptcy, tens of thousands of pages of regulations, and tens of thousands of new regulators.

Wouldn’t it be simpler and more effective to sharply reduce run-prone funding, at least by intermediaries likely to spark runs?[2]

- Sornette, Didier, and Ryan Woodard. “Financial bubbles, real estate bubbles, derivative bubbles, and the financial and economic crisis.” Econophysics Approaches to Large-Scale Business Data and Financial Crisis, Springer Japan, 2010, pp. 101-148. p. 137.

- Cochrane, John H. “Toward a Run-free Financial System.” Across the Great Divide: New Perspectives on the Financial Crisis, edited by Martin Neil Baily and John B. Taylor, Hoover Institution Press, 2014, pp. 197-250.