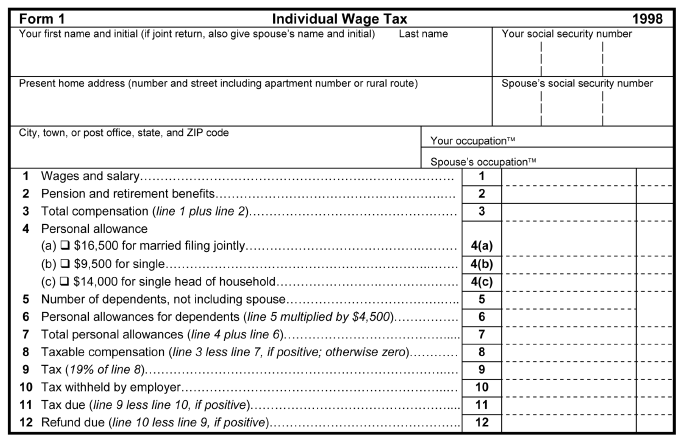

Figure 3.1 Individual Wage-Tax Form

Flat tax cuts government micromanagement

Direct compliance costs, both in filing and in buying expert advice, exceed $100 billion. Direct tax-planning costs—consulting with lawyers, accountants, purveyors of tax shelters, and financial planners—exceed $35 billion. Revenue lost to the Treasury due to evasion exceeds $100 billion. Distortions from pursuing tax-advantaged investments in the form of lost output may exceed $100 billion. Finally, the lobbyists who inhabit Washington’s K Street corridor probably cost the economy more than $50 billion. Total individual and corporate income taxes for the 1993 fiscal year (October 1, 1992—September 30, 1993) were about $625 billion.

Our flat tax is not an academic abstraction. We have designed tax forms, rewritten the Internal Revenue Code, and worked out all the practical details.

Flat tax cuts government unfairness to wage earners, increasing investment

Our proposal is based squarely on the principle of consumption taxation. Saving is untaxed…

Our flat tax… is designed to be fair from the start. It will insulate the poor from all taxation and will dramatically limit the taxation of wages and salaries, especially among those who are most successful and productive. It will pay for these tax reductions by imposing a sensible tax at a low rate on business income, thus raising the amount of federal revenue collected from businesses.

The current personal and corporate taxes tax wages heavily and business income lightly. The flat tax would reverse this inequity and benefit the great majority of Americans, whose income comes almost entirely in the form of wages. In comparison to the current personal income tax on wages, the flat tax would impose a lower burden on both low earners and high earners.

Flat tax cuts government complexity for wage earners

We believe that the simplicity of our system is a central feature.

The tax form for our wage tax is self-explanatory (see figure 3.1). To make the tax system progressive, only earnings over a personal or family allowance are taxed. The allowance is $25,500 for a family of four in 1995 but would rise with the cost of living in later years. All the taxpayer has to do is report total wages, salaries, and pensions at the top, compute the family allowance based on marital status and number of dependents, subtract the allowance, multiply by 19 percent to compute the tax, take account of withholding, and pay the difference or apply for a refund.

Those who believe that life would grind to a halt with the loss of deductions for interest and charitable contributions need to consider how they would alter their lives the morning the flat tax took effect. They would fire their lawyers and accountants and instead seek advice and information on sound economic investments.

Flat tax cuts government complexity for business people

It is not the purpose of the business tax to tax businesses. Fundamentally, people pay taxes, not businesses. The idea of the business tax is to collect the tax that the owners of a business owe on the income produced by the business.

All a business’s income derives from the sale of its products and services. On the top line of the businesstax form… goes the gross sales of the business—its proceeds from the sale of all its products. But some of the proceeds come from the resale of inputs and parts the firm purchased; the tax has already been paid on those items because the seller also has to pay the business tax. Thus, the firm can deduct the cost of all the goods, materials, and services it purchases to make the product it sells. In addition, it can deduct its wages, salaries, and pensions, for, under our wage tax, the taxes on those will be paid by the workers receiving them. Finally, the business can deduct all its outlays for plant, equipment, and land. (Later we will explain why this investment incentive is the right one.) Everything left from this calculation is the income originating in the firm and is taxed at the flat rate of 19 percent.

Business would be expected to run a tighter ship with the much higher returns that a 19 percent rate affords over current high rates. Tickets for box seats at baseball stadiums, club memberships, business travel, company cars, and a host of other business outlays that incorporated and unincorporated firms regularly purchase would now cost the owners of that business eighty-one cents of after-tax income, rather than the current sixty cents.

When flat tax cuts government, it unleashes growth

We project a 3 percent increase in output from increased total work in the U.S. economy and an additional increment to total output of 3 percent from added capital formation and dramatically improved entrepreneurial incentives. The sum of 6 percent is our best estimate of the improvement in real incomes after the economy has had seven years to assimilate the changed economic conditions brought about by the simple flat tax. Both the amount and the timing are conservative.[1]

- Hall, Robert E., and Alvin Rabushka. The Flat Tax. Hoover Press, 2007.