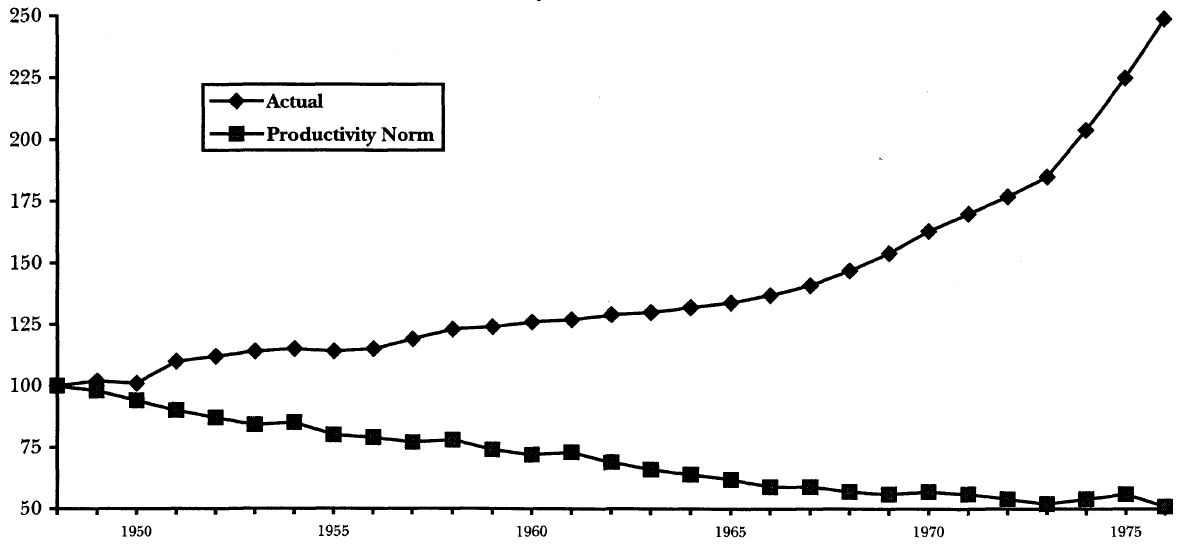

Actual price levels, and price levels with normal deflation, 1948-1976 [1:12]

Deflation healthy sign overcome by government

…western monetary institutions in the era of the classical gold standard were far from being perfect. Governments frequently intervened in the production of money through price control schemes, which they camouflaged with the pompous name of “bimetallism.” They actively promoted fractional-reserve banking, which promised ever-new funds for the public treasury. And they promoted the emergence of central banking through special monopoly charters for a few privileged banks.[2:18]

A paper money system… merely distributes the existing resources in a different manner; some people gain, others lose. It is a system that makes banks and financial markets vulnerable, because it induces them to economize on the essential safety valves of business: cash and equity. Why hold any substantial cash balances if the central bank stands ready to lend you any amount that might be needed, at a moment’s notice? Why use your own money if you can finance your investments with cheap credit from the printing press?[2:7]

Paper money has caused an unprecedented increase of debt on all levels: government, corporate, and individual. It has financed the growth of the state on all levels, federal, state, and local. It thus has become the technical foundation for the totalitarian menace of our days.[2:21]

…in practice, there are at any point in time two, and only two, fundamental options for monetary policy. The first option is to increase the quantity of paper money. The second option is not to increase the paper money supply. Now the question is how well each of these options harmonizes with the basic principles on which a free society is built.[2:29]

Inflation is an unjustifiable redistribution of income in favor of those who receive the new money and money titles first, and to the detriment of those who receive them last. In practice the redistribution always works out in favor of the fiat-money producers themselves (whom we misleadingly call “central banks”) and of their partners in the banking sector and at the stock exchange. The rich stay rich (longer) and the poor stay poor (longer) than they would in a free society.[2:33-34]

Deflation healthy sign of productivity growing

…throughout modern history, improvements in aggregate productivity have overshadowed occasional setbacks. According to one widely-used estimate, from 1948 to 1976 total factor productivity in the US grew by an average annual rate of 2 per cent. Had a (total factor) productivity norm been in effect during this time, US consumer prices in 1976 would on average have been roughly half as high as they were just after the Second World War.[1:11]

Deflation healthy sign because saving pays off

Imagine if all prices were to drop tomorrow by 50 percent. Would this affect our ability to feed, cloth, shelter, and transport ourselves? It would not, because the disappearance of money is not paralleled by a disappearance of the physical structure of production. In a very dramatic deflation, there is much less money around than there used to be, and thus we cannot sell our products and services at the same money prices as before. But our tools, our machines, the streets, the cars and trucks, our crops and our food supplies—all this is still in place. And thus we can go on producing, and even producing profitably, because profit does not depend on the level of money prices at which we sell, but on the difference between the prices at which we sell and the prices at which we buy. In a deflation, both sets of prices drop, and as a consequence for-profit production can go on.

There is only one fundamental change that deflation brings about. It radically modifies the structure of ownership. Firms financed per credits go bankrupt because at the lower level of prices they can no longer pay back the credits they had incurred without anticipating the deflation. Private households with mortgages and other considerable debts to pay back go bankrupt, because with the decline of money prices their monetary income declines too whereas their debts remain at the nominal level.

…bankruptcies—irrespective of how many individuals are involved—do not affect the real wealth of the nation, and in particular that they do not prevent the successful continuation of production. The point is that other people will run the firms and own the houses—people who at the time the deflation set in were out of debt and had cash in their hands to buy firms and real estate. These new owners can run the firms profitably at the much lower level of selling prices because they bought the stock, and will buy other factors of production, at lower prices too.[2:25-27]

Deflation healthy sign because adding value pays off

…deflation… stops inflation and destroys the institutions that produce inflation. It abolishes the advantage that inflation-based debt finance enjoys, at the margin, over savings-based equity finance. And it therefore decentralizes financial decision-making and makes banks, firms, and individuals more prudent and self-reliant than they would have been under inflation.

Deflation healthy sign that liberty is secure

…deflation eradicates the re-channeling of incomes that result from the monopoly privileges of central banks. It thus destroys the economic basis of the false elites and obliges them to become true elites rather quickly, or abdicate and make way for new entrepreneurs and other social leaders.[2:40]

Deflation puts a brake—at the very least a temporary brake—on the further concentration and consolidation of power in the hands of the federal government… It dampens the growth of the welfare state, if it does not lead to its outright implosion.

… deflation is at least potentially a great liberating force. It… brings the entire society back in touch with the real world, because it destroys the economic basis of the social engineers, spin doctors, and brain washers.

…if our purpose is… to restore… a free society, then deflation is the only acceptable monetary policy.[2:41]

- Selgin, George. Less than zero. The case for a falling price level in a growing economy. The Institute of Economic Affairs, 1997.

- Hülsmann, Jörg Guido. Deflation and liberty. Ludwig von Mises Institute, 2008.