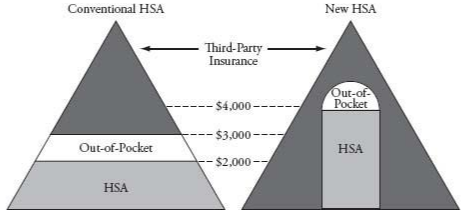

Figure 11.2

Figure 11.2

Ideal health insurance

Imagine you could… create an insurance plan just for 1,000 people.

Terms of entry

Each person should pay a premium equal to the expected healthcare costs he or she adds to the 1,000‑person pool. …or others must make a charitable contribution on their behalf.

Terms of renewal

…a reasonable rule is to raise or lower everyone’s premium at renewal time, based on whether the whole group’s costs have been more or less than expected.

Third-party insurance vs. self-insurance

…we should encourage individuals to purchase directly most diagnostic tests, most forms of preventive medicine and most primary care. It may make… sense for the pool to pay for vaccinations, …or to require that members obtain them…

Suppose… a member is diagnosed with cancer. …bad decisions early on could generate larger subsequent costs for the group. Such considerations may create a presumption in favor of paying for all treatment costs from the pool in cases where the entire treatment regime promises to be expensive.

Table 11.1. General Rules

| Individual Choice | Collective Choice |

| 1. No risky medical event. | 1. Risky medical event. |

| 2. Price of third-party insurance is high. | 2. Price of third-party insurance is low. |

| 3. Exercise of choice creates no externalities [risks for others]. | 3. Exercise of choice creates risks for others. |

Implications for HSA design

The design pictured on the right side of Figure 11.2 [above] is preferable. Under this design, the plan pays first dollar for some treatments, while leaving the insured free to pay even higher amounts for other services.

Design of third-party payment

…why not fix the plan’s cost for an entire treatment regimen? If patients selected doctors who charge more, they paid the difference out of pocket.

Terms of exit

After an automobile accident, a claims adjuster inspects the damage, agrees on a price, and writes the car owner a check.

…members would commit to the pool for a period of, say, three, four, or five years. …leaving the pool would require the consent of the pool.

…if a healthy member left… plan A to join… plan B, B would compensate A… …if a sick member left A to join B, A would compensate B…

Ideal health insurance would allow insurers to specialize in the business of insurance

Ideal health insurance would allow… market developments by providing a mechanism for people to leave one insurance pool and join another (without extra cost) when their health condition changes.

Ideal health insurance would be improved by the free flow of information

Under ideal health insurance… the insurer and the insured are on the same team, with a similar interest and objective: acquiring good value in a competitive market.[1]

- Goodman, John C. Priceless: Curing the Healthcare Crisis. Independent Institute, 2012. Chapter 11.