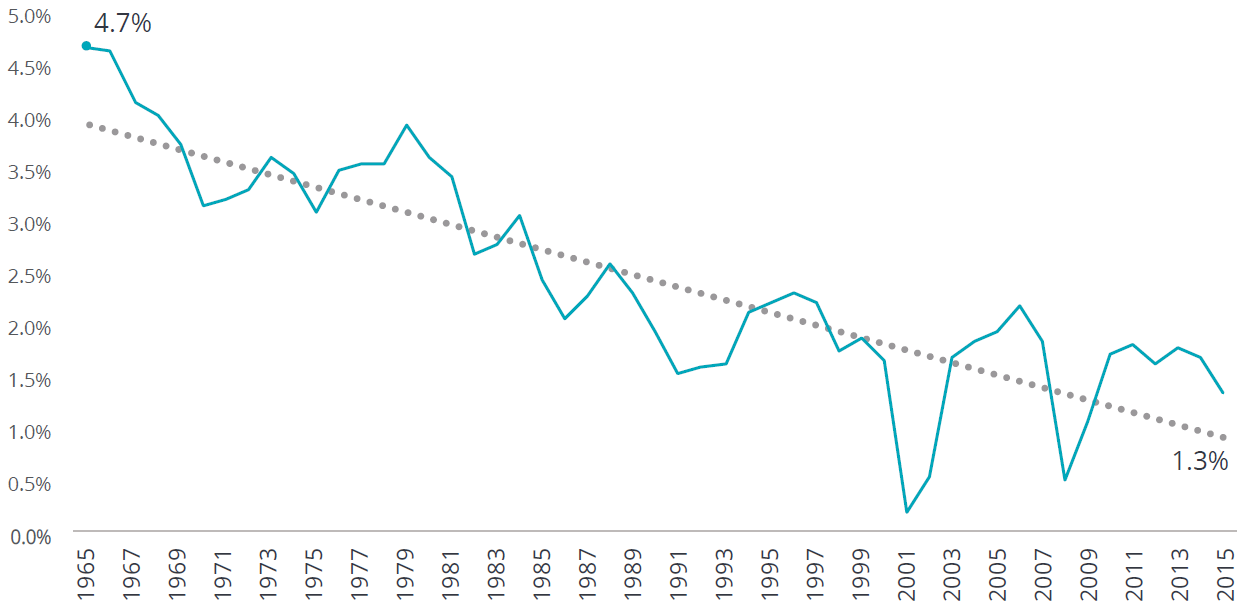

Return on assets of US firms [1]

Profit or loss means buying low now and selling high later, using capital and labor to add value

The activities of the entrepreneur consist in making decisions. He determines for what purpose the factors of production should be employed.[2]

The capitalist-entrepreneur buys factors or factor services in the present; his product must be sold in the future. He is always on the alert, then, for discrepancies, for areas where he can earn more than the going rate of interest. The difference between the general interest rate and his actual return is his… profit…

Profit or loss measures net value added compared to all other value-adding

Every entrepreneur… invests in a process because he expects to make a profit, i.e., because he believes that the market has underpriced and undercapitalized the factors in relation to their future rents. If his belief is justified, he makes a profit. If his belief is unjustified, and the market, for example, has really overpriced the factors, he will suffer losses.

…profits are an index of maladjustment, but in a sense precisely opposed to that usually meant. …profits are an index that maladjustments are being met and combatted by the profit-making entrepreneurs. These maladjustments are the inevitable concomitants of the real world of change. A man earns profits only if he has, by superior foresight and judgment, uncovered a maladjustment—specifically an undervaluation of certain factors by the market. By stepping into this situation and gaining the profit, he calls everyone’s attention to that maladjustment and sets forces into motion that eventually eliminate it. [3]

Profit or loss is finally booked when customers agree to final prices and quantities

…entrepreneurs… are unconditionally and totally subject to the sovereignty of the buying public, the consumers.

The consumers by their buying and abstention from buying elect the entrepreneurs in a daily repeated plebiscite as it were. They determine who should own and who not, and how much each owner should own.

Each ballot of the consumers adds only a little to the elected man’s sphere of action. To reach the upper levels of entrepreneurship he needs a great number of votes, repeated again and again over a long period of time, a protracted series of successful strokes. He must stand every day a new trial, must submit anew to reelection as it were.

Profit and loss are the instruments by means of which the consumers pass the direction of production activities into the hands of those who are best fit to serve them.[2]

It is the consumers… who make the decisions for the economic system. The consumers, through their buying and abstention from buying, decide how much of what will be produced, at the same time determining the incomes of all the participating factors. And every man is a consumer.[3]

- Hagel, John, et al. 2016 Shift Index. The paradox of flows: Can hope flow from fear? Deloitte University Press, 2016, p. 26.

- Von Mises, Ludwig. Planning for freedom, and twelve other essays and addresses. 3rd ed., Libertarian Press, 1974, pp. 108-150.

- Rothbard, Murray N. Man, economy, and state with power and market. 2nd ed., Ludwig von Mises Institute, 2009, pp. 509-516.