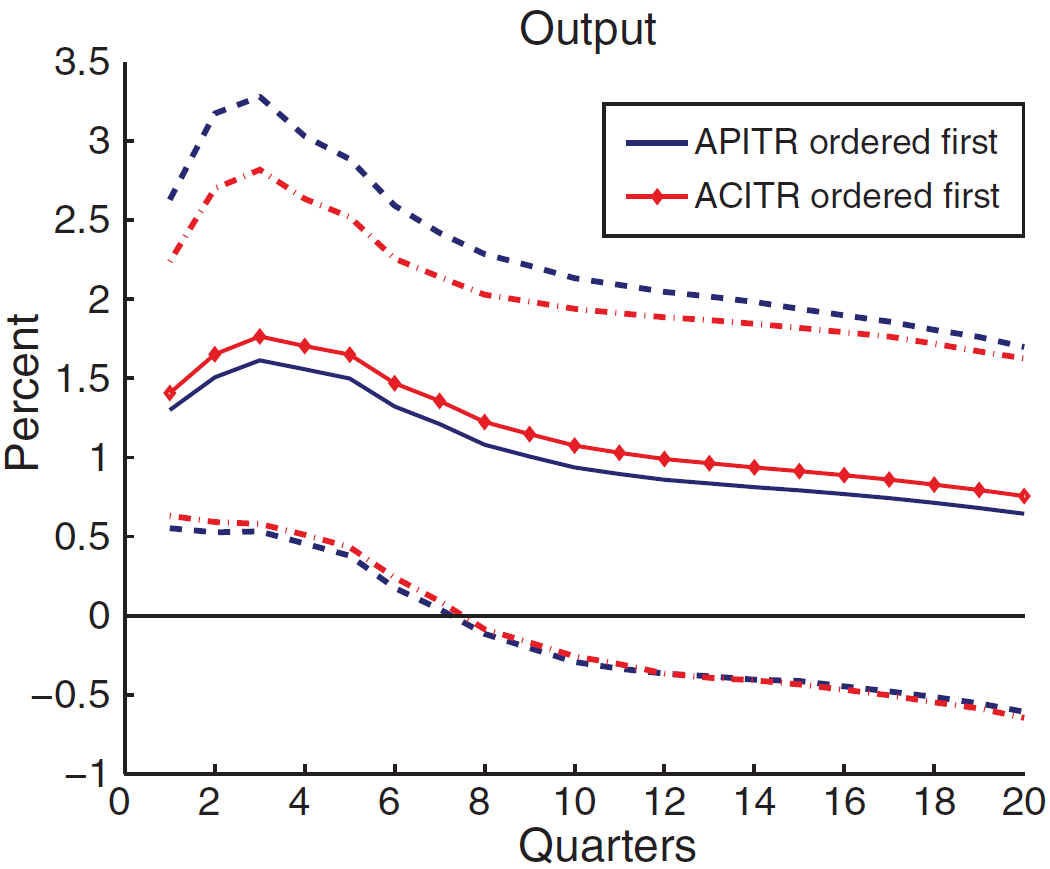

Tax cuts provide GDP increases that are

rapid, large, and long-lived

- Hypothetical response if average personal income tax rate was cut 1% and then immediately raised back up.

- Based on quarterly post-WWII US data.

- Two alternative factoring-out sequences were used to remove the effects in the data from simultaneous corporate tax cuts.

- Dashed lines are 95% confidence intervals.[1]

Capital gains tax cuts increase output quite a lot,

personal income tax cuts increase output just a little,

sales tax cuts reduce output

We find that the average values of the capital, labor, and consumption tax multipliers are 2.74, 1.39, and 0.62, respectively. That is, a one dollar decline in tax revenue from a cut in the tax rate on capital income stimulates output by approximately two dollars and seventy four cents on average.

The capital tax multiplier ranges from a low of 2.54 to a maximum value of 3.08. The range for the labor tax multiplier is 1.27 to 1.56. The consumption tax multiplier varies least… 60 to 0.65.[2]

Government stimulus spending reduces output

…the estimated multiplier for temporary defense spending is 0.4–0.5 contemporaneously and 0.6–0.7 over 2 years. If the change in defense spending is “permanent”… the multipliers are higher by 0.1–0.2.

These multipliers are all significantly less than 1… [3]

Debtor-government stimulus spending kills output

When debt levels are high, increases in government expenditures may act as a signal that fiscal tightening will be required in the near future. Moreover, as recent events in southern Europe and Ireland illustrate, these adjustments may need to be sudden and large. The anticipation of such adjustment could have a contractionary effect that would tend to offset whatever short-term expansionary impact government consumption may have.

Under these conditions, fiscal stimulus may therefore be counter-productive.

…we built a sample of country-episodes where the ratio of the total debt of the central government exceeded 60% of GDP. Our estimate for the impact multiplier is close to zero, and we estimate a long run multiplier of -3.[4]

- Mertens, Karel, and Morten O. Ravn. “The dynamic effects of personal and corporate income tax changes in the United States.” The American Economic Review 103.4 (2013): 1212-1247.

- Sims, Eric, and Jonathan Wolff. “The State-Dependent Effects of Tax Shocks.” (2016).

- Barro, Robert J., and Charles J. Redlick. “Macroeconomic Effects From Government Purchases and Taxes.” The Quarterly Journal of Economics 126.1 (2011): 51-102.

- Ilzetzki, Ethan, Enrique G. Mendoza, and Carlos A. Végh. “How big (small?) are fiscal multipliers?” Journal of Monetary Economics 60.2 (2013): 239-254.